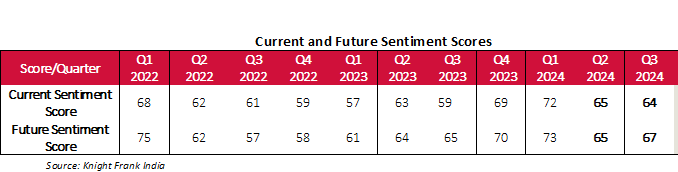

Mumbai : The 43rd edition of the Knight Frank – NAREDCO Real Estate Sentiment Index for Q4 2024 (October–December 2024) indicates a sense of cautious optimism among real estate stakeholders. Both the Current and Future Sentiment Scores are still above the optimistic benchmark of 50, although they have experienced a downward adjustment from the previous quarter, influenced by global economic changes and concerns about economic growth. The Current Sentiment Index Score has decreased to 59 in Q4 2024, down from 64 in Q3 2024, suggesting a thoughtful recalibration. Likewise, the Future Sentiment Score has adjusted to 59 in Q4 2024, compared to 67 in the last quarter. Despite these adjustments, both current and future sentiments remain solidly in the optimistic range, highlighting ongoing confidence in the long-term outlook of the sector.

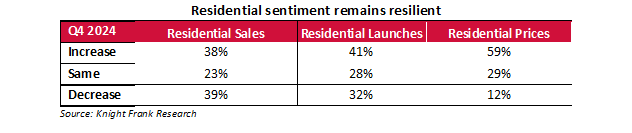

The residential market outlook in Q4 2024 sustainsoptimism with a 59% response rate for an expected rise in residential prices, while 38% of the stakeholders anticipate an increase in sales. A notable portion of 41% anticipated rise in residential launches.

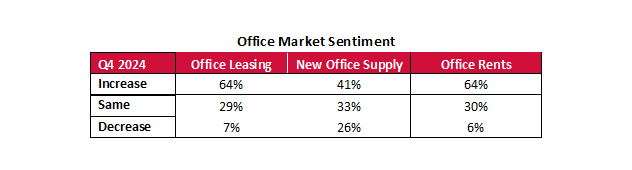

The office market outlook exhibits buoyancy on all key parameters – leasing, supply and rent – as the stakeholders remain confident about the performance of this asset class in the next six months.

The quarterly Knight Frank-NAREDCO report captures the current and future sentiments towards the real estate sector, as well as economic conditions and funding availability as perceived by the supply-side stakeholders and financial institutions. A score of 50 represents a neutral view or status quo; a score above 50 demonstrates a positive sentiment; and a score below 50 indicates a negative sentiment.

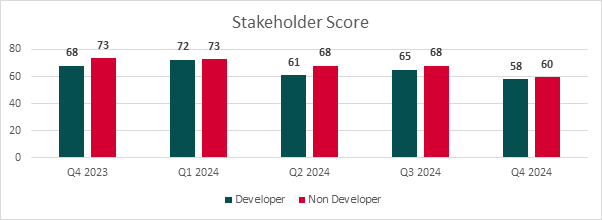

Sentiments of Developers and Non-Developers

Developer Future Sentiment has adjusted downwards to 58 in Q4 2024 from 65 in Q3 2024. This shift reflects a cautious yet forward-looking perspective as developers respond to evolving market and economic indicators.

Non-developer stakeholders (including banks, financial institutions, and PE Funds) have revised their outlook slightly to 60 in Q4 2024. This cautious optimism reflects a balanced anticipation of challenges and opportunities in the upcoming months.

Shishir Baijal, Chairman and Managing Director, Knight Frank India, said, “The Real Estate Sentiment Index, while remaining in the optimistic zone, reflects a measured sense of caution. This moderation is driven by evolving geopolitical dynamics and domestic economic conditions. Global economic policy shifts, particularly changes in U.S. tariff regimes, along with a slowdown in domestic growth, have led the real estate sector to adopt a more cautious stance. In the coming quarters, developers and investors are expected to maintain a wait-and-watch approach, aiming to sustain the momentum the sector has built over the past few years.” Residential market outlook

The future sentiment for the residential market remains in the optimistic territory though confidence in residential launches has moderated, with 32% of respondents now expecting a decline in new launches in the first and second quarter of CY 2025, a significant denudation in sentiments from just 4% in Q4 2023.

A comparable trend is seen in residential prices, while 88% of respondents maintain that prices will increase or remain stable, the share of respondents anticipating a decline in prices is 12% in Q4 2024, rising from 1% in Q4 2023. This growing caution among stakeholders reflects a more measured outlook on the residential market. In the Q4 2024 future Sentiment survey, 38% of the respondents expect residential sales to increase, and 23% predicted stability. This demonstrates steady confidence in the market, with overall sentiment pointing towards moderation. In Q4 2024, 41% of survey respondents opined that residential launches will improve, while 28% indicated stability. 59% of the survey respondents in Q4 2024 expect residential prices to increase, supported by consistent demand and limited inventory in prime markets.

Hari Babu, President-NAREDCO, said, “The Q4 2024 Sentiment Index report highlights a cautious optimism in the residential sector, with stakeholders adopting a more measured approach. While the decline in sentiment scores is notable, it’s essential to recognize that the scores remain firmly in the optimistic zone. The moderation in residential launches, sales, and prices is a reflection of the prevailing economic and market conditions. However, it’s heartening to note that the office market continues to demonstrate resilience, driven by strong leasing momentum and rental growth. I believe it’s crucial for developers and stakeholders to be adaptable and responsive to changing market conditions. We must focus on creating sustainable and affordable housing options that cater to the evolving needs of homebuyers. Despite the short-term challenges, I remain optimistic about the long-term prospects of the Indian real estate sector. With the government’s focus on infrastructure development and housing for all, I am confident that the sector will continue to grow and thrive in the years to come.”

Office market outlook

The office outlook strengthened further on all three parameters (leasing, new office supply and rent) as survey respondents remained confident about this sector’s long-term potential. Stakeholders opined that India’s office market demand will bolster in the first half of 2025.

In Q4 2024, 64% of survey respondents expect office leasing to improve, driven by positive corporate sentiments and continued recovery in demand. 41% of respondents predicted an increase in office supply, indicating stability in continued sector growth , while 64% of the survey respondents expect office rents to increase, driven by growing demand of high-quality office spaces.

Economic Scenario

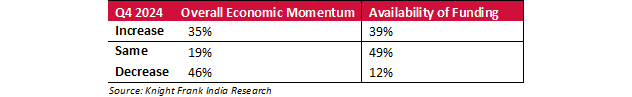

Based on the survey findings, 54% of respondents have a positive outlook on the economic scenario. This marks a significant decline from Q4 2023 when 90% of respondents expressed optimism about India’s economic growth. The tempered sentiment can be attributed to recent downward revisions in GDP projections, rupee depreciation, and other macroeconomic factors. Consequently, 46% of respondents exhibit a moderated optimism regarding India’s economic resilience and growth potential.

Furthermore, 39% anticipate an increase in funding availability, reflecting a more cautious confidence compared to 57% in Q4 2023. Notably, the proportion of respondents expecting a decrease in funding has risen to 12% in Q4 2024, up from 6% in Q4 2023. This underscores the fact that while investors continue to recognize the sector’s long-term potential—as indicated by the non-developer overall future sentiment index score—stakeholders are likely to have a more cautious stance in the next 6 months.